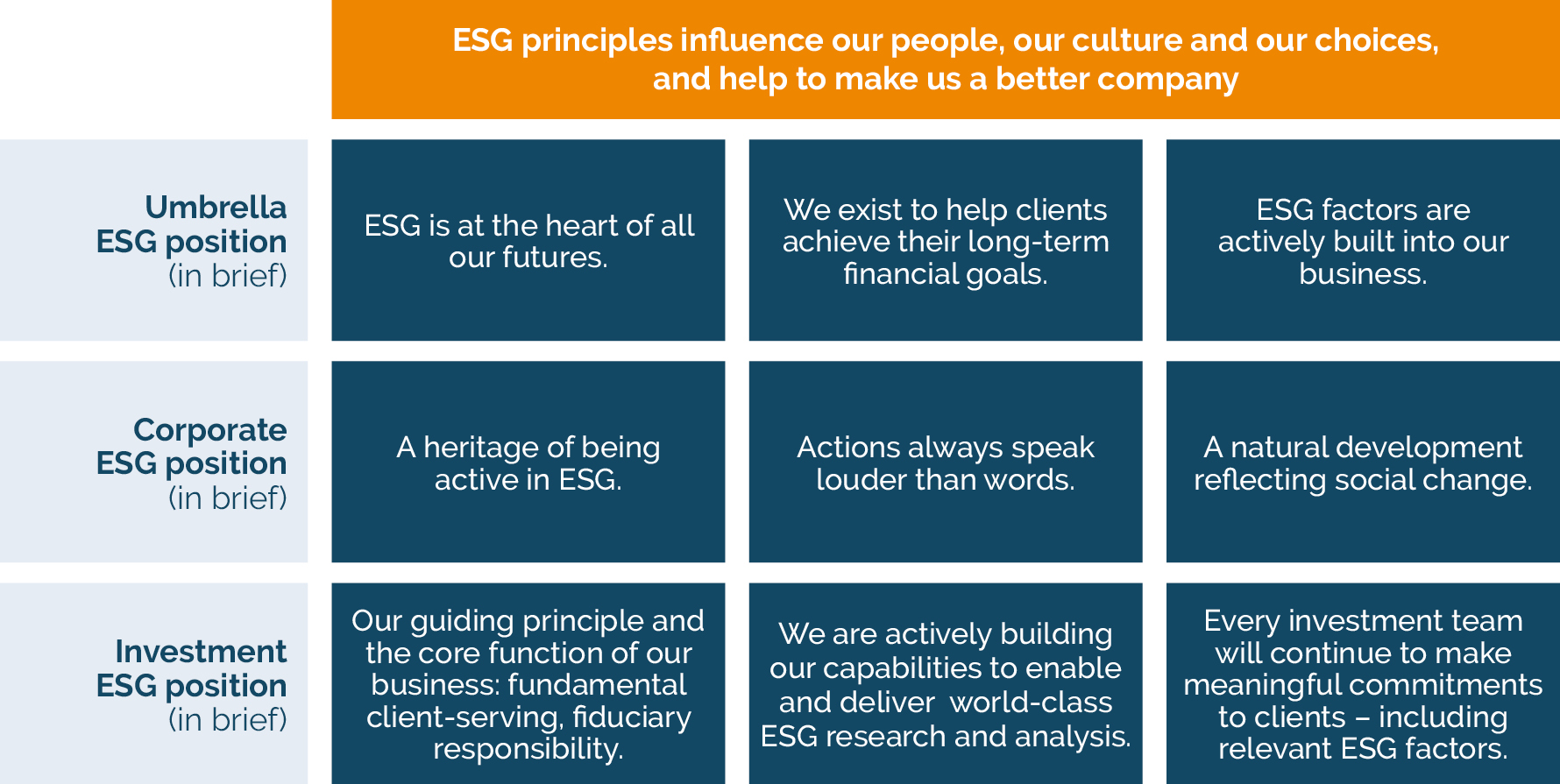

This clarity needs to be aligned with escalating regulatory demands to disclose manager and investee ESG data (which could be damning), previously not found in the public domain. Both factors demand managers to develop an understanding and articulation of ESG at a corporate and product level.

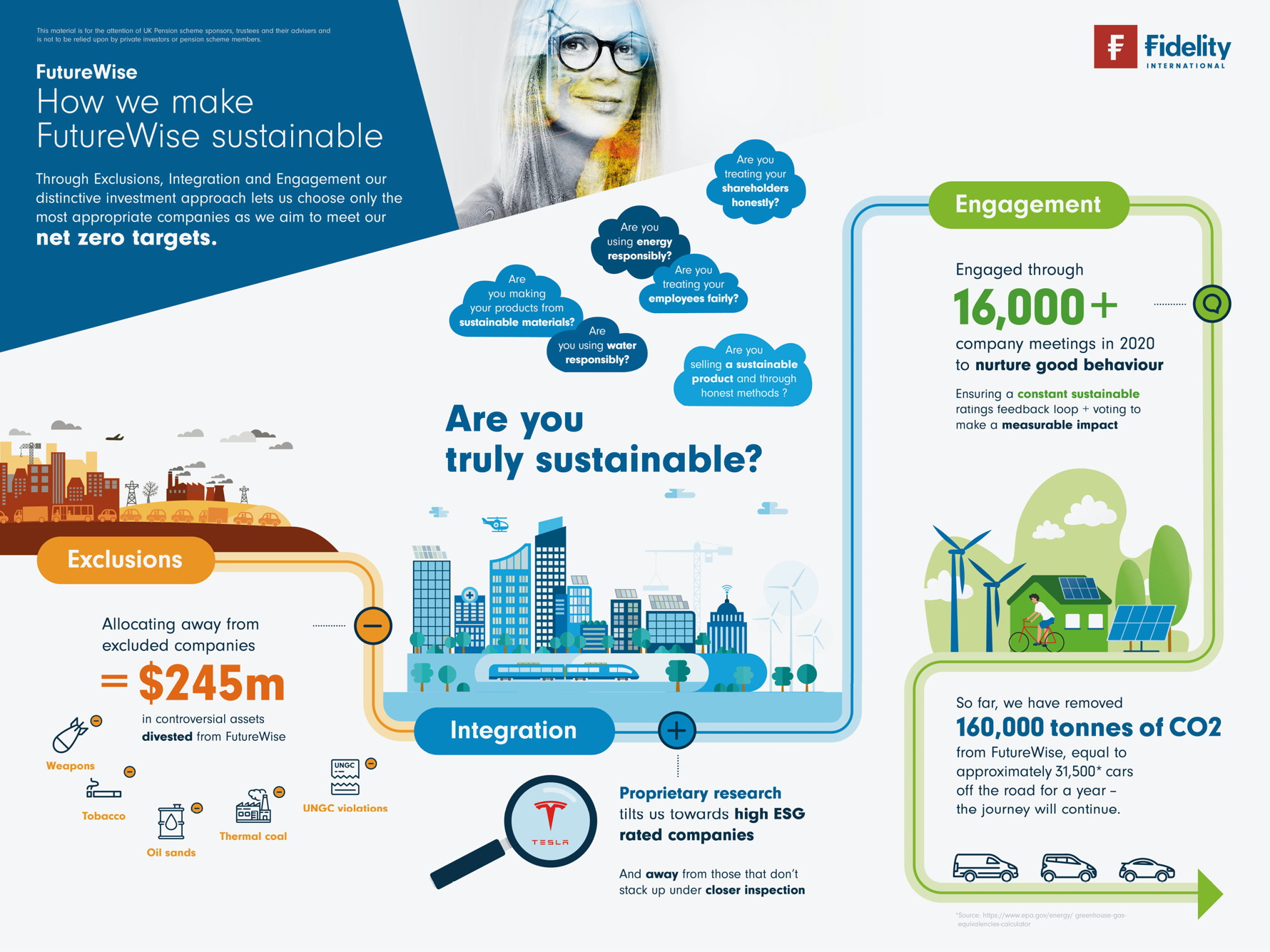

At Fin, we have supported clients since 2018 in defining their ESG and Responsible Investing stories. This brings an understanding to develop compelling and proprietary propositions with a highly creative visual theme.

Below are examples of our success stories, others not mentioned include our work for Apex Group, CVC, Amundi, Findlay Park, and Insight Investment.