Between the US and Europe there are over 25,000 investment brands (AM,WM,PE,IB,ETF’s)

So, with a backdrop of this intense competition, and the deteriorating levels of concentration in clients and prospects, you would have thought that the pursuit of a unique brand positioning would be paramount to all investment brands, yet as revealed in a recent Citywire survey 60% of asset managers share the same messaging!

There are a number of reasons why the investment industry shies away from individuality ranging from: wanting to be part of the club, fear of being different, brand cynicism and lack of imagination.

So, to create a brand of distinction, here are 3 key strategies that will help you:

1. TRUST – Investors can sniff out the real from the fake

Brands are all about trust, and trust has to be earned. However there are some do’s and don’ts along that path.

Buyers are inherently cynical and look for the cracks.

If brands are claiming to be more than they actually are, it will be quickly sniffed out.

Don’t be a “wannabe”.

If you are small don’t try and look large, celebrate your size as a virtue. Don’t over promise and stick to what you do brilliantly by making a point of saying what you are not.

Don’t follow fads and make a clear view why you don’t.

Don’t cover up, be open, especially around nationality, celebrate your individuality.

You don’t have to “disrupt”, there is plenty of space for a simple high quality offer.

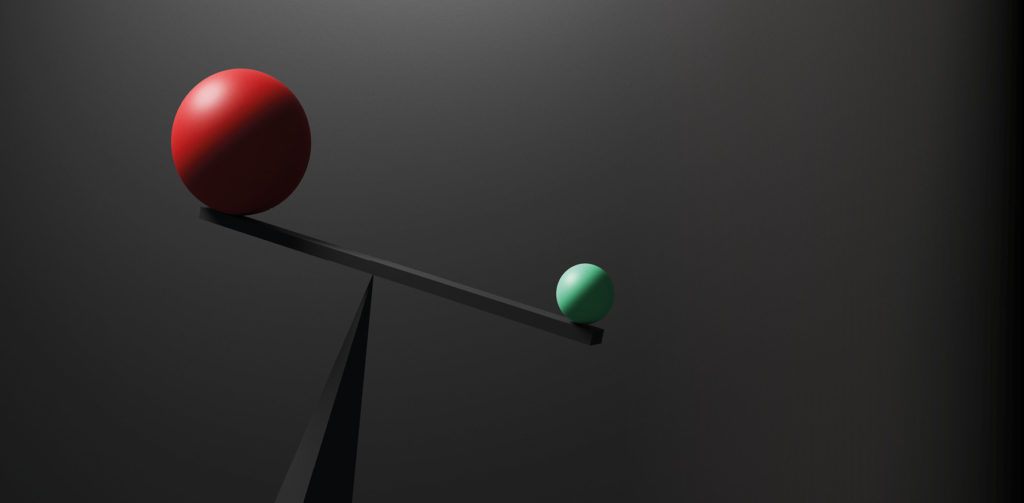

2. CLARITY – People best receive information, one message at a time

People forget 95% of information they consume. Think of the brain like a person being thrown 5 tennis balls at once, they’ll most likely drop all of them. However, throw them one ball at a time and chances are they’ll catch it every time.

Be short, simple and consistent across all communication channels and continue to dig for difference. This is hard and many give up after the first layer, which inevitably leads them towards the expected and well-trodden routes. The interesting message however, lies beneath in the subtleties and when found it should be made the hero.

Try to avoid clichéd terms like: solutions, bespoke, proactive, client centric. Instead, think “What does the market need and how do we solve a problem?”

Avoid jargon and don’t be overly corporate, people respond to people not faceless entities.

3. CREATIVITY – Where logic meets emotion

Investors instinctively buy into the story and emotion not the graph and charts. Brands tell the story.

There is too much corporate uniformity and creativity is the prime moment to express your individuality. Clichés become invisible. Be brave or don’t bother.

Investment companies target bright people and bright people look for ideas that aren’t always obvious, but may need decoding, something that creates a ‘smile in the mind’.

Words and visuals are like song writing, they need each other but can happen in all sorts of ways. Explore tools like Getty and Chat GBT and then push beyond, they are not the end solution. Always make sure you’re connecting the creativity with brand, so as not to dilute.

Be confident in your brand personality, as no one else can own it.

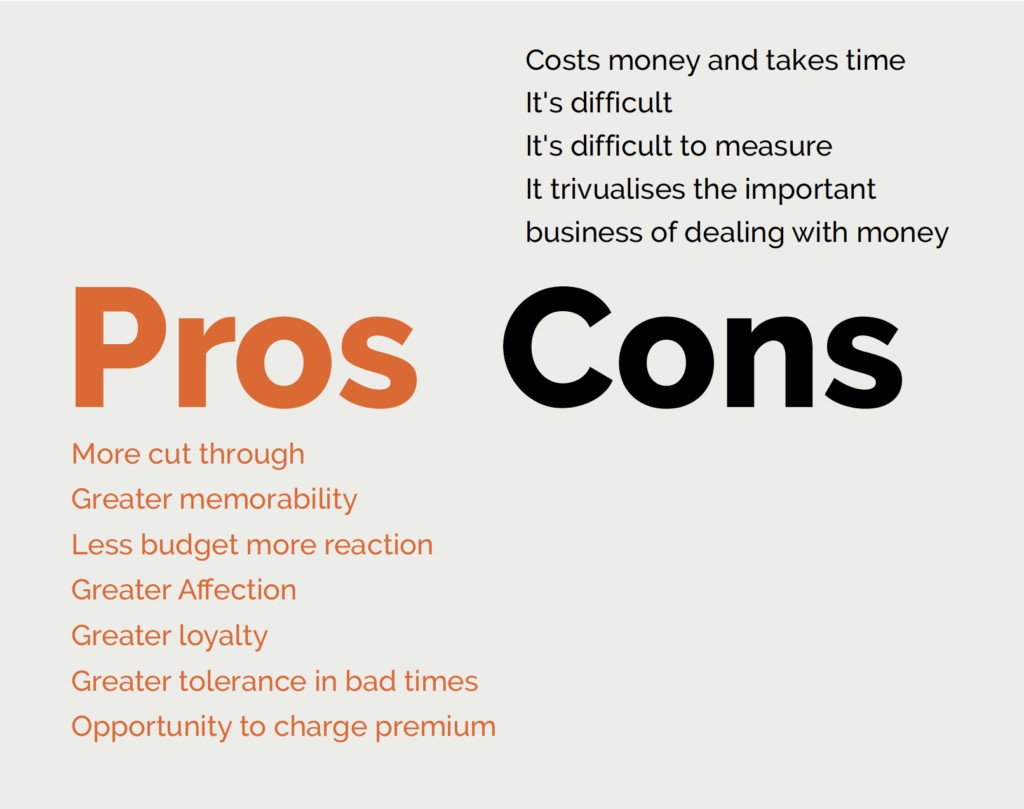

If you are considering embarking on an exercise to freshen up your brand, chances are you’re going to have to argue your corner with the board and those holding the purse strings. Here are a few thoughts on the answer to the question: Is it worth it?