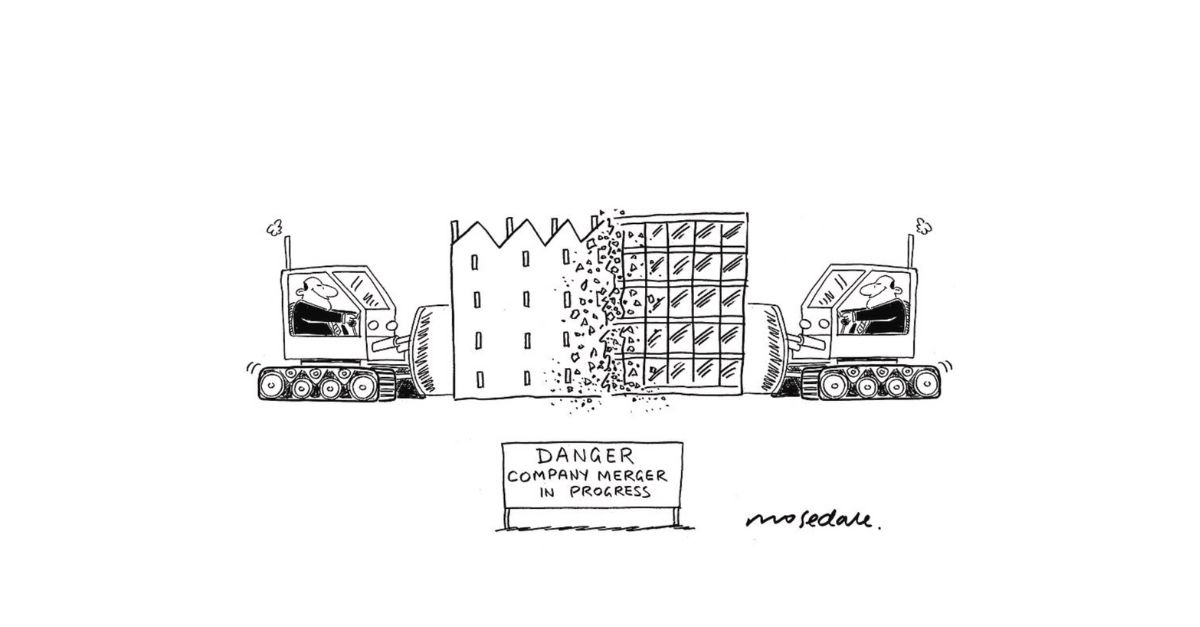

When considering mergers and acquisitions (M&A) in the wealth management space, it’s natural to focus on the big numbers—valuations, cost synergies, and growth potential. But those deal mechanics are just the tip of the iceberg. Beneath the surface lie the real challenges that can make or break a M&A: how well the firms integrate, how their cultures align, and—often overlooked—what happens to the brand.

In a sector built on legacy, long-term relationships and trust, branding and meaningful DNA are essential to stand out, and cut through the noise.

What Can Go Wrong?

Loss of Brand Equity

Clients don’t just invest in financial services—they invest in people and brands they trust. So, when a familiar firm is suddenly absorbed into a culturally foreign brand, that trust can be shaken. A rebrand that feels cold or corporate can risk alienating long-standing clients, where perhaps the relationship begins to feel transactional, not personal.

Cultural Misalignment

When two firms merge but don’t share the same values, tone, or philosophy, the cracks show quickly. Employees may disengage. Clients pick up on inconsistencies. And the brand loses its clarity and authenticity.

Mixed Messages

If there isn’t a unified brand story or messaging strategy, clients start receiving mixed signals. They may not understand the new firm’s mission, values, or even what it now offers. This confusion erodes confidence—and credibility.

How to Get It Right!

Brand Architecture Planning

Before the ink is dry, leadership teams need to decide how the new brand will be structured. Will it be a single, unified name (a “branded house”)? Or will individual firms retain their identity under a shared umbrella (a “house of brands”)? Sometimes the answer is a hybrid, like keeping a local name but linking it to the larger group. The right approach depends on your clients, your market, and your long-term goals.

Unified Brand Narrative

Clients want reassurance, not just new logos. The brand story post-merger should speak directly to them: why the change happened, how it benefits them, and what remains the same. Emphasise continuity, evolution, and your ongoing commitment to care—not just scale or efficiency.

Retaining Legacy Value

If parts of the old brand carry emotional or local significance—like a long-standing name, tagline, or trusted advisor—don’t toss them aside. These elements can act as anchors for loyalty and trust. It is imperative, your messaging should continue to focus on what really matters to clients: peace of mind, independence, and a long-term view of their wealth.

In Action

In wealth management, as in other sectors, a strong brand should reflect both the relationships built with employees and clients, and the firm’s broader philosophy and culture. Today, a successful brand must combine core values, thematics, and a clear sense of purpose with a distinctive personality. The most effective rebrands honour the past while confidently looking to the future.

London & Capital and Waverton IM recently rebranded as W1M, drawing inspiration from the postcode of London & Capital’s original office in Marylebone. Respecting the history of one brand is challenging—doing so for two simultaneously is even more complex. While they got lucky from the natural link between the postcode and Waverton’s acronym, their work still stands as a strong example of a rebrand that feels inclusive, rather than disruptive. Customers and employees alike recognise their story in the brand. The ‘old’ remains visible in the ‘new’—which, in this case, is concise, elegant, and confident.

Internally, it’s vital to establish clear brand guidelines that are understood, embraced, and consistently applied. A merger of two brands requires careful balance: maintaining continuity and heritage while integrating—or discarding—elements that could confuse or alienate stakeholders.

Ultimately, branding in wealth management isn’t just marketing – it’s your business strategy in disguise. It forms foundation of trust in your people, your values, and your advice. Brand and culture should be at the heart of any M&A strategy, not treated as an afterthought. Handled poorly, brand missteps can erode value and disrupt relationships. Handled carefully, branding becomes a powerful lever for differentiation and stability. The firms that prioritise brand from day one are best positioned to retain legacy clients, empower teams, and grow stronger in an increasingly consolidated market.